#Cambridge associates vc benchmarks plus#

The company’s data science team built out a “ fund performance percentile calculator” for its fund managers to compare their performance against other funds using detailed data from AngelList’s own syndicates and funds plus performance data from other sources. How do you calculate IRR? How do you make that comparable with other funds and their underlying portfolio investments?ĪngelList hopes that its latest project can start to solve these challenges, and in the process, bring more transparency to performance within the VC asset class. When the company exits, the acquirer pays for the investment with three tranches of cash over 18 months.

#Cambridge associates vc benchmarks pro#

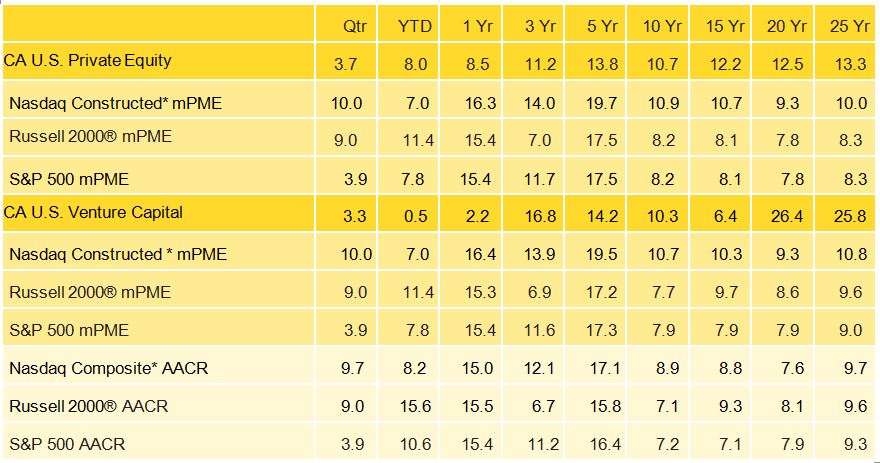

Let’s say a fund invested into a startup at the seed, did a follow on in the series A, and did pro rata investments in the series B and C rounds. Everyone strives to be in the first quartile (the top 25%), and many fund CFOs have a bevy of tricks to squeeze a few more points out of their metrics to get their funds above that key cutoff line.Ĭomparing performance gets even more challenging though as you get more granular with the data. Traditional benchmarks calculated by groups like Cambridge Associates bucket VC funds into “vintage years” and place funds into quartiles based on metrics like IRR (rate of return adjusted for time) and DPI (or the amount of capital returned to limited partners against dollars paid into a fund). There is immense opacity in the venture capital industry, and that has made comparing venture funds notoriously difficult.

0 kommentar(er)

0 kommentar(er)